Search Listings

Search Listings

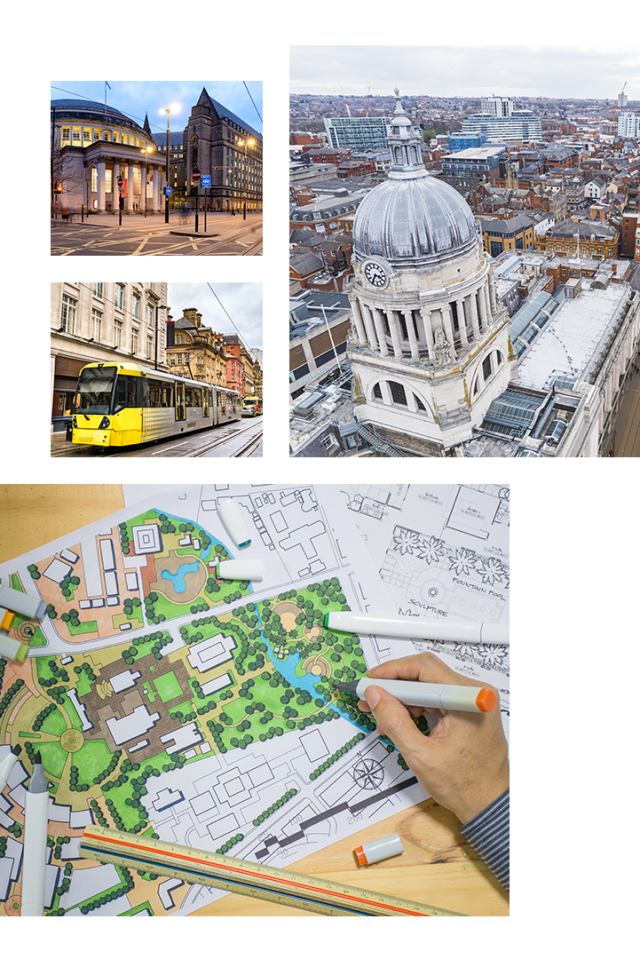

We offer a range of public sector property solutions to support the growth of central and local government, healthcare, education and housing associations.

Public Sector Expert

Table of contents

At Eddisons, we provide a leading range of strategic advisory services to the public sector so leaders can make better decisions about their properties. Our understanding of the public sector and vast experience in all aspects of the real estate industry allow us to develop specialist public sector property solutions that support your delivery and accelerate economic growth.

Our strategic advice empowers clients to implement initiatives and make informed decisions about their investment properties and occupied portfolios. We work with organisations across the UK, including central and local government, education and social housing, and are on public sector frameworks so it’s much easier to procure our services.

That includes:

As well as focusing on the financial return of your properties, our public sector property advice helps you reduce operating costs, improve the utilisation of built assets and benefit from economies of scale.

We draw on our commercial experience across all sectors to deliver property solutions that are tailored to fit your unique requirements. As a national firm, we invest in the latest training and technology to provide the highest quality advice, which is backed by the local knowledge of our regional offices throughout the country.

Please get in touch if you have a specific project in mind or would like to know more about our strategic advisory property services.

The public sector property solutions we offer broadly focus on three areas: occupier advisory, development consultancy and transaction advisory.

Occupier advisory

We take a process-driven consulting approach to estate planning to align your property portfolio with your operating, workforce, financial and risk objectives. Our occupier advisory service includes:

Development consultancy

We provide holistic advice across the development lifecycle of a project. Our services include:

Transaction advisory

Our established transaction management methodology can maximise the profitability of your property in the following ways:

450+ Strong Team

Our reach covers the UK with a network of over 30 UK offices.

Find the right professional using the below dropdowns.

Or, browse by Service / Location

Service

Location

450+

Brilliant people

180 years

In business

30

Offices nationwide

// Public Sector Property Solutions

Reading Borough Council - Strategic Development Advice

// Public Sector Property Solutions

Improving NHS Trusts Estate Across Suffolk

// Public Sector Property Solutions

Delivering Ministry of Justice (MOJ) Estate Strategy

Senior Director

Senior Consultant

Head of Sustainability and Decarbonisation

Director

Local office finder

Eddisons boasts a national presence, with offices located throughout the UK.

Discover your nearest one today.

Find Your Office

Contact details

2nd Floor, 10 Wellington Place, Leeds, LS1 4AP

We're ready to take your call and can quickly pass you through to the right department.

Our team

We're proud to employ more than 450 talented individuals working across a multitude of disciplines.

Office finder

Eddisons is rapidly growing; emphasised by our nationwide network of 30 offices across the UK.

Contact us

We're ready to take your call and can quickly pass you through to the right department.

Newsletter

Join thousands of property managers, occupiers, landlords and investors receiving the latest insights.

This site uses cookies to monitor site performance and provide a more responsive and personalised experience. You must agree to our use of certain cookies. For more information on how we use and manage cookies, please read our Privacy Policy.