Search Listings

Search Listings

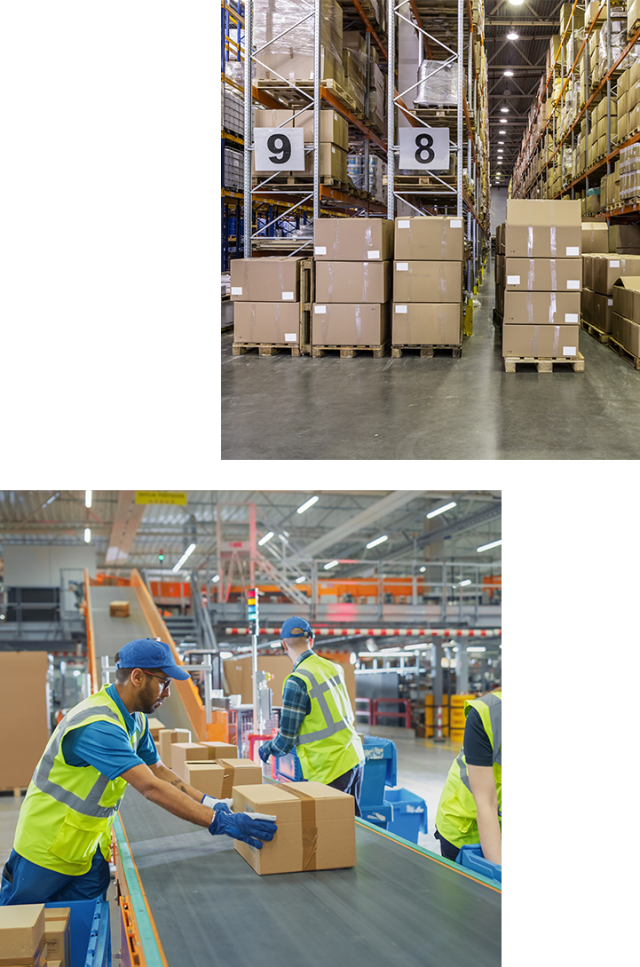

Industrial property remains one of the most resilient sectors in UK commercial real estate. For company directors, shareholders and those responsible for building management, understanding where the market is heading can make the difference between a well-timed acquisition and a costly misstep.

This outlook examines the forces shaping the industrial property market in 2026, from rental dynamics and regional variations to emerging opportunities and persistent challenges. Whether you are considering expanding your operational footprint or disposing of surplus assets, our guide can help you approach these decisions with confidence.

The UK industrial and logistics sector has demonstrated remarkable resilience through recent economic turbulence. While the frantic demand levels seen during the pandemic have normalised, the market remains fundamentally sound, supported by structural shifts in how businesses operate and distribute goods.

The national vacancy rate for industrial and logistics space currently stands just under 8%, having risen from historic lows of around 3% in 2021. While this increase may appear concerning at first glance, it largely reflects a return to more sustainable market conditions rather than oversupply.

Grade A availability has dropped by around 6% over the past year, with approximately 48.5 million square feet now available. New speculative development starts have slowed as developers exercise caution, though roughly 12 million square feet of speculative space is expected to reach the market by early 2026.

Prime industrial rents have continued their upward trajectory, albeit at a more moderate pace than the exceptional growth recorded between 2020 and 2022. Average prime headline rents for mid-box and multi-let industrial units reached approximately £15.55 per square foot by mid-2025, reflecting year-on-year growth of around 4%.

Take-up of industrial and logistics space over 100,000 square feet is running approximately 27% ahead of the pre-pandemic average, demonstrating sustained occupier appetite. Build-to-suit activity has been particularly strong, totalling nearly 10 million square feet nationally and representing a 7% increase on the previous year.

E-commerce has returned to its pre-pandemic levels, but the structural shift towards online retail remains permanent. This translates into sustained demand for warehouse space, particularly for last-mile delivery facilities in urban and peri-urban locations.

Returns processing has also emerged as a significant driver of warehouse demand, with retailers requiring dedicated facilities to handle the growing volume of returned goods efficiently.

The Bank of England base rate is expected to ease gradually towards approximately 3.5% by mid-2026, which should support a recovery in both occupier and investor confidence. GDP growth projections remain modest at around 1.4% for 2026, though this may actually benefit the industrial sector by encouraging efficiency-focused investment in supply chain infrastructure.

Inflation continues to moderate towards the 2% target, with CPI forecast to average approximately 2.3% by Q4 2026. This should provide businesses with greater certainty for planning capital expenditure and lease commitments.

The development pipeline continues to contract, with new speculative starts falling as developers carefully assess market conditions and viability. Construction cost inflation, labour availability and financing challenges have all contributed to more cautious development decisions.

The government's Industrial Strategy, announced in June 2025, aims to remove structural barriers to industrial development. This includes measures to streamline planning processes and reduce developer burdens, though the practical impact on timelines remains to be seen.

Minimum Energy Efficiency Standards (MEES) regulations are tightening, with an interim target of EPC C by 2028 and EPC B by 2030 for commercial lettings. Approximately 28% of commercial properties currently hold ratings of D or lower, presenting significant upgrade requirements for landlords.

Forward-thinking owners are investing in upgrades now to protect rental values and maintain tenant appeal, while also accessing green finance options and demonstrating corporate responsibility.

The Midlands Golden Triangle, formed by the M1, M6 and M42 motorways, remains the UK's premier logistics location. Its four-hour drive time catchment serves approximately 90% of the UK population, explaining the breadth of occupier interest and sustained demand.

Manchester, Leeds and Liverpool continue to attract significant industrial investment, benefiting from relatively lower land costs, strong transport connectivity and substantial workforce availability. Yorkshire has led regional rental growth at 6.7% year-on-year, reflecting robust occupier demand

Glasgow and Edinburgh have recorded rental growth of 5.7% year-on-year, reflecting strong demand from logistics, manufacturing and technology occupiers. The Central Belt is positioned to attract further investment as renewable energy infrastructure expands.

Wales concentrates industrial activity around Milford Haven and Cardiff, where automotive and aerospace supply chains drive demand. The Celtic Freeport designation offers customs and tax benefits that are attracting new investment.

London and the South East face acute space constraints, with vacancy in prime logistics submarkets remaining below 2%. This scarcity is driving rents upward annually, as occupiers compete for limited stock.

The Thames Gateway and port-adjacent locations benefit from excellent connectivity for cross-border trade. Felixstowe and Harwich continue to serve as major logistics gateways, with Freeport designations providing additional investment incentives.

Build-to-suit activity has experienced a resurgence, with major corporations increasingly willing to commit to long-term developments that meet their precise specifications. This approach allows occupiers to secure strategic locations, control building specifications and lock in rental terms before construction completes.

For developers, pre-let agreements reduce speculative risk and support financing arrangements. Occupiers benefit from certainty of delivery timelines and the ability to influence design features that enhance operational efficiency.

Land scarcity in urban areas is driving innovation in warehouse design, with multi-storey facilities emerging as a solution in high-value locations. While construction costs are higher than traditional single-storey units, proximity to customers and reduced delivery times can justify the premium for certain occupiers.

Small and medium-sized enterprises are contributing to growth by taking smaller industrial units as flexible storage or micro-fulfilment spaces. These occupiers often combine warehouse and offices, requiring coordinated logistics solutions.

The conversion of underperforming retail assets to industrial use continues to offer opportunities for investors and developers. Former retail parks and warehouses can often be adapted for last-mile logistics or light industrial purposes, benefiting from existing infrastructure and established locations.

Brownfield regeneration is increasingly favoured by planning authorities, offering sustainability benefits and avoiding greenfield development pressures. Sites with existing industrial heritage may benefit from simplified planning processes and community support.

Prime rental growth will continue rising, driven by supply constraints and sustained occupier demand for quality space. Growth will be geographically uneven, with northern regions and Scotland expected to outperform.

Some prime yield compression may emerge before the end of 2026, assuming continued improvement in financing conditions. However, secondary yields are likely to remain under pressure as investors price in upgrade requirements and obsolescence risk.

MEES compliance windows are approaching, with EPC C required by 2028 and EPC B by 2030. Landlords should be assessing their portfolios now and planning upgrade programmes to avoid compliance gaps that could render properties unlettable.

The proposed ban on upwards-only rent reviews in commercial leases is expected to take effect in early 2027. While primarily targeted at the retail sector, this reform will affect industrial leases with rent review provisions, requiring landlords to adjust expectations for rental income trajectories.

Business rates revaluation impacts continue to work through the market, with some areas seeing significant changes to rateable values. Understanding the rates position is increasingly important for both occupational and investment decisions.

Whether you are acquiring new industrial space, disposing of surplus assets or optimising your existing portfolio, our team combines local market knowledge with national coverage to deliver practical solutions.

Our agency specialists can help you identify suitable properties, negotiate favourable terms and complete transactions efficiently. We act for occupiers, investors and landlords across the industrial sector, providing impartial advice tailored to your objectives.

For accurate market intelligence, our valuations team provides RICS-compliant appraisals for acquisitions, disposals, secured lending and corporate reporting. Understanding true market value is essential for sound decision-making in a dynamic market.

Our building consultancy services support due diligence, condition assessment and project management for refurbishment or development schemes. From initial feasibility through to completion, we help protect your interests and add value across the property lifecycle.

If you are considering buying, leasing or selling an industrial property, our experts are ready to help. We offer free initial consultations to understand your requirements and explain how we can support your objectives.

To get started, please call 0207 022 2380 or complete the form below to arrange a conversation with a relevant specialist.

You can also explore our case studies to see how we have helped other businesses with their industrial property challenges, or browse our news and insights for the latest market intelligence.

Local office finder

BTG Eddisons boasts a national presence, with offices located throughout the UK.

Discover your nearest one today.

Find Your Office

Contact details

2nd Floor, 10 Wellington Place, Leeds, LS1 4AP

Our team

We are proud to employ more than 450 talented individuals working across a multitude of disciplines.

Office finder

BTG Eddisons is rapidly growing; emphasised by our nationwide network of 35 offices across the UK.

Contact us

We are ready to take your call and can quickly pass you through to the right department.

Newsletter

Join thousands of property managers, occupiers, landlords and investors receiving the latest insights.

This site uses cookies to monitor site performance and provide a more responsive and personalised experience. You must agree to our use of certain cookies. For more information on how we use and manage cookies, please read our Privacy Policy.